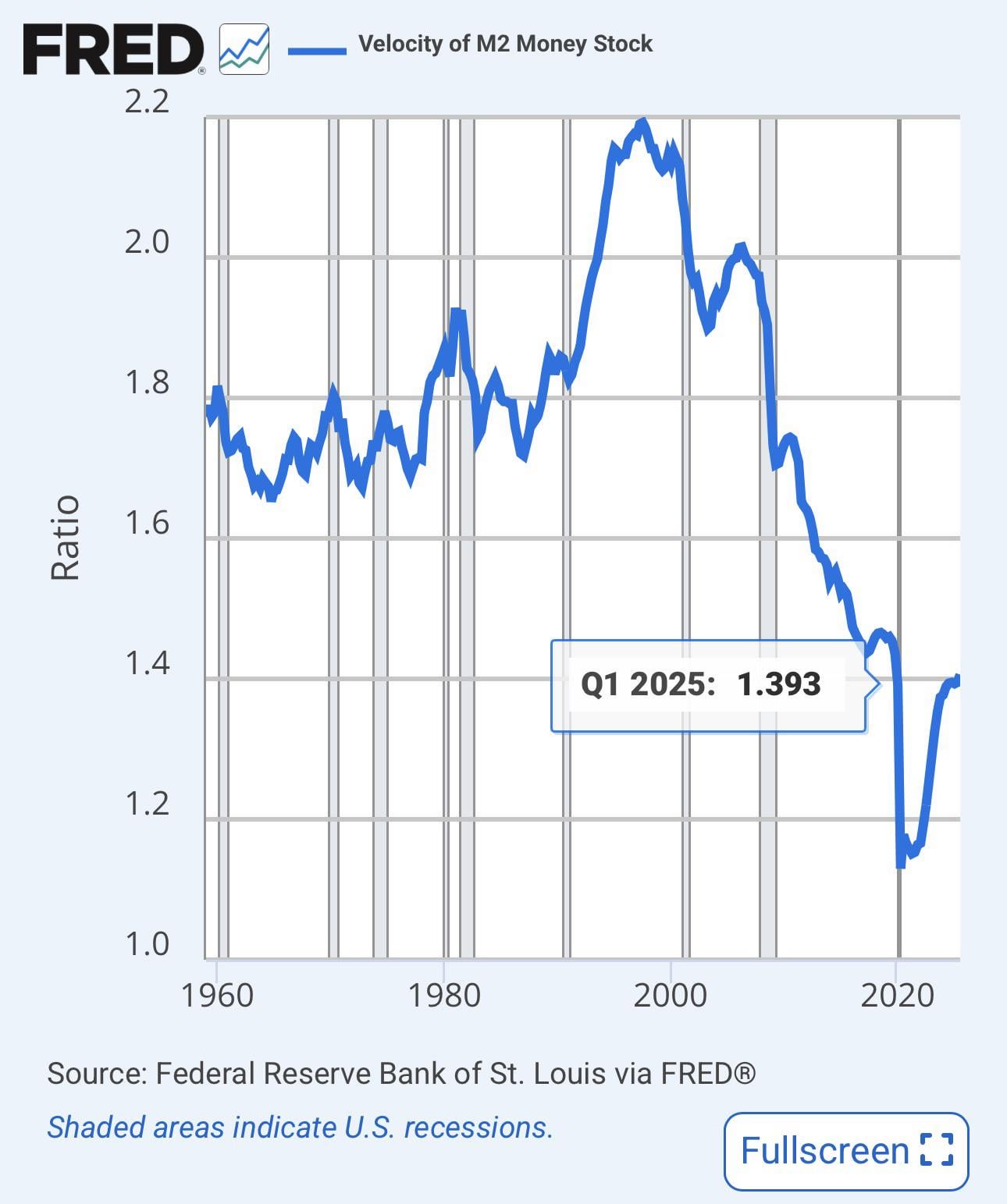

The M2 money supply has had its momentum functionally collapse since 2007-2008 and it never really recovered. Even after bumping up after Covid, the M2 momentum never fully recovered to its pre Covid levels. It seems like a major issue that money is trading hand less and less, though I admit I have only a partial understanding of economics. I was wondering if someone could let me know how much of an issue this is and if there is a way for it to recover back to more stable levels?

Posted by dayvena

2 Comments

Small comment: I said momentum when I meant velocity. Sorry about that.

V = Py/M. Velocity increases with inflation or real gdp growth, but declines with growth in the money stock. The collapse in velocity post 2008 is largely due to quantitative easing, but M2 is a pretty broad measure of the money stock (it includes things like savings account balances and some other stuff) so monetary policy is only part of the story.