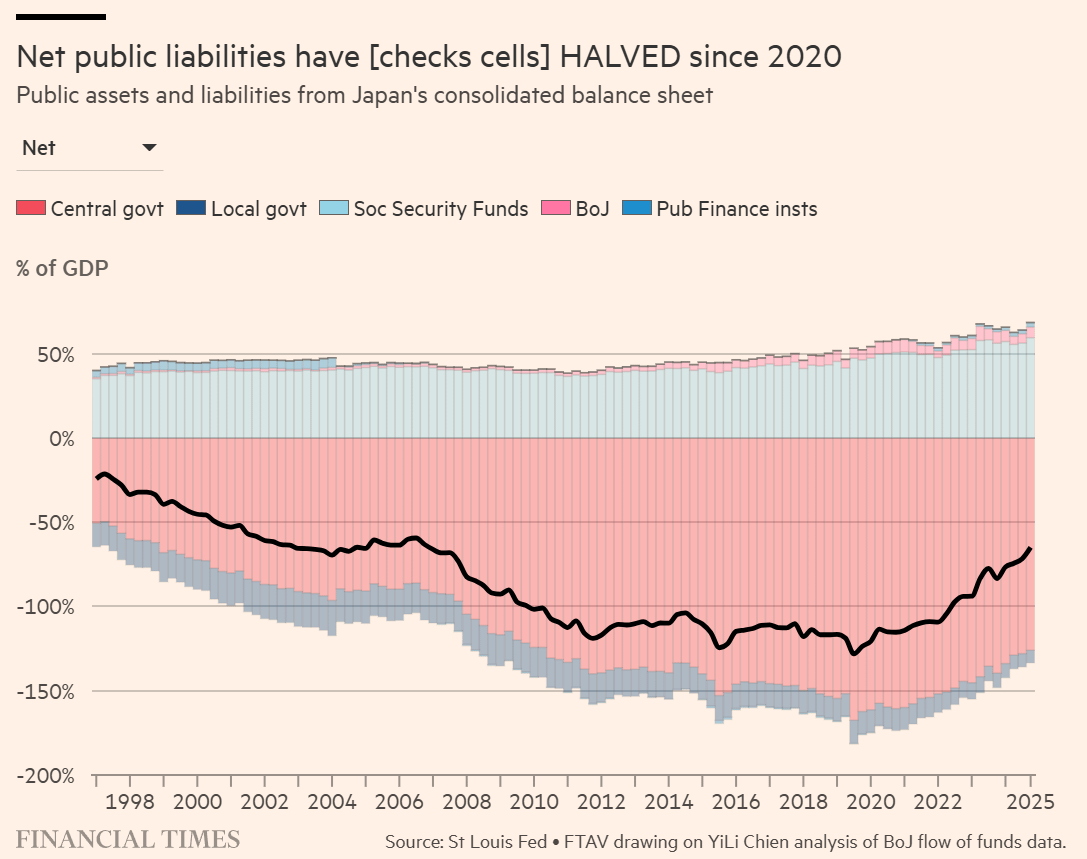

Back in 2022, YiLi Chien (St Louis Fed) calculated that Japan had the same public sector net liability as the US (119%) [Source].

When updating the numbers for 2025, Toby Nangle and Chien found that Japan’s total net public sector liability had fallen to a mere 65 per cent of GDP by the end of the third quarter of 2025.

Gift Article: https://giftarticle.ft.com/giftarticle/actions/redeem/678a078e-0b37-4ac5-9f81-798a65f890c8

Posted by donquixote25

3 Comments

I’m not economically literate so a couple question for the economics folks.

* Is this the right framing? Do other governments have similar net debt ratios or is Japan’s still high?

* Will this allow Takaichi to pursue responsible fiscal expansion without tanking the economy?

They estimate that Japan’s use of “cheap domestic funding to take highly-levered long positions in risky assets” has earned the government “an additional 6 percent of GDP per annum above its funding costs” over the past decade.

SIX PER CENT OF GDP PER ANNUM!

This helps explain how Japan has “managed to defy the standard logic of debt sustainability”, they say.

Can it continue? The trio of researchers reckon yes. Or at least almost. They project “that the consolidated Japanese government could earn an expected return around 3.9 percent of GDP on its current risky portfolio”. though they caveat this by observing that the “ability of Japan’s public sector to sustain high levels of debt depends on stable and low funding costs from bondholders”. So, it depends.

Could the US copy Japan’s path to fiscal sustainability? Only at the cost of the dollar:

>The United States faces similar fiscal pressures but is unlikely to replicate Japan’s approach. Unlike Japan, the US government has relied more on external funding to support its deficits. A prolonged policy that sought to help the federal government finance borrowing with below-market interest rates could erode the dollar’s reserve currency status and further diminish the convenience yield on US Treasury bonds.

Given the President’s desire for low rates and seeming ambivalence towards a weaker dollar, anything’s possible.

How on earth is their pension fund solvent when half the country is retired?